IRS is now accepting returns – Let a dedicated CPA handle your taxes!

How To File For A Tax Extension?

How To File For A Tax Extension?

Table of contents

Key takeaways...Read more

What is a tax filing extension?...Read more

How to get a tax filing extension?...Read more

How does filing an extension work?...Read more

How FlyFin helps file tax extensions?...Read more

What is the tax extension deadline in 2024?...Read more

What do I need to file for a tax extension?...Read more

Who can file tax extensions?...Read more

What is the tax extension form?...Read more

When I file a tax extension, do I also pay taxes in October?...Read more

Is filing tax extension free?...Read more

Can small businesses file tax extensions?...Read more

What is the difference between getting an extension of filing taxes and filing back taxes?...Read more

Key takeaways

- Form 4868 is the tax extension form.

- April 15 is the tax filing deadline, and also the tax extension deadline. It acts only as a filing deadline, not as a payment one.

- Anyone can file a tax extension, the IRS needs no explanations.

What is a tax filing extension?

How to get a tax filing extension?

How does filing an extension work?

How FlyFin helps file tax extensions?

What is the tax extension deadline in 2024?

What do I need to file for a tax extension?

Who can file tax extensions?

What is the tax extension form?

When I file a tax extension, do I also pay taxes in October?

Is filing tax extension free?

Can small businesses file tax extensions?

What is the difference between getting an extension of filing taxes and filing back taxes?

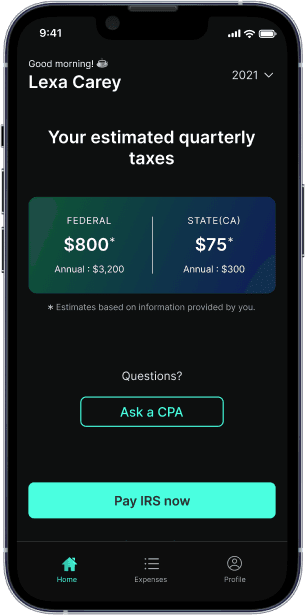

What’s FlyFin?

Expert tax CPAs ensure 100%-accurate tax filing

A.I. finds every tax deduction, eliminating 95% of your work

On average users save $3,700