IRS is now accepting returns – Let a dedicated CPA handle your taxes!

How Much Do You Make File Taxes?

How Much Do You Make File Taxes?

Table of contents

Key takeaways:...Read more

How much do I have to make to file taxes?...Read more

Impact of standard deduction on the amount of taxes owed...Read more

How much do you have to make to pay taxes when self-employed?...Read more

Income threshold for dependents...Read more

Do I have to file taxes?...Read more

Who needs to file a tax return?...Read more

What is the minimum income to file taxes?...Read more

When can you start filing taxes 2024?...Read more

How much do I have to make to pay taxes?...Read more

How much do you have to make to file taxes for free?...Read more

Key takeaways:

- The minimum income limit to file taxes is $13,850 for single filers under 65, $27,700 for joint filers under 65 and $30,700 for couples older than 65.

- The minimum taxable income is $400 for self-employed individuals.

- Filing tax returns can help you get tax credits like the EITC and the child tax credit.

How much do I have to make to file taxes?

Impact of standard deduction on the amount of taxes owed

How much do you have to make to pay taxes when self-employed?

Income threshold for dependents

Do I have to file taxes?

Who needs to file a tax return?

What is the minimum income to file taxes?

When can you start filing taxes 2024?

How much do I have to make to pay taxes?

How much do you have to make to file taxes for free?

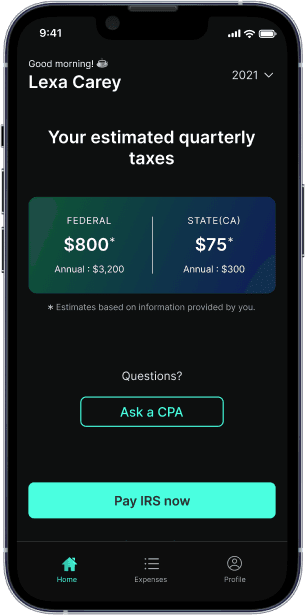

What’s FlyFin?

Expert tax CPAs ensure 100%-accurate tax filing

A.I. finds every tax deduction, eliminating 95% of your work

On average users save $3,700