Quarterly tax deadline is Jan 15. See how much you owe penalties

Home › Deductions › Can I Deduct Museum Tickets

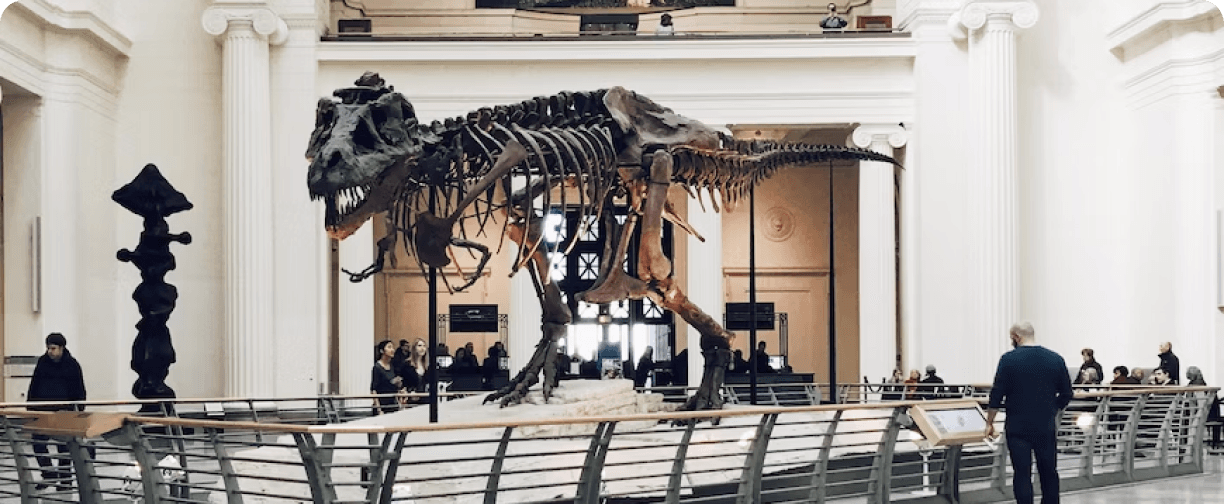

Can I Deduct Museum Tickets?

Here’s what the CPA’s have to say

If you visit museums or art galleries for business purposes, you can deduct the entrance fees from your taxable income.

In this case, Dusti is a professional artist, and for her visiting art museums is a legitimate business expense since it is necessary for her to learn about different art techniques and to grow in her profession by watching the work of other artists.

So, her membership fee to an art museum is an ordinary and necessary expense.

Can I Deduct Museum Tickets?

Tax deductions for entertainment purposes are hard to come by unless you're in the right profession. Under special circumstances, the IRS does allow some individuals to deduct certain expenses related to their profession.

Table of contents

Can you claim Museum tickets as a business expense?

To count as a deduction, or write-off, an expense has to serve a clear business purpose in your line of work. The IRS’s definition of what it considers to be a business expense is an expense that is both ordinary and necessary.

Here, in order to claim museum tickets as a tax deduction, you need to be in the line of business where you are required to visit a museum or an art gallery for research purposes. Some common freelance professions where you can claim the tax deduction include:

- Artists

- Illustrators

- Sculptors

- Writers

- Historians

- Connoisseurs

- Art Appraiser

Who can claim museum tickets as a deduction?

To deduct any expense, it must be directly related to your business. If you're a part of the art community, where it's necessary for you to visit museums and art galleries as a part of your research methods, then you can deduct it. Some of the self-employed professionals who can claim museum tickets as a tax deduction include:

Artists/Illustrators:

As an artist, you may be required to visit different art galleries and museums for research purposes. Here, you can claim a deduction for the membership or entrance fee for such events on your income tax return.

Writer:

As a writer, you may have to visit a museum to learn more about a historical event that you wish to write about in your book, here, you can claim a deduction for the same as a part of your research methods.

Art Appraiser:

As an art appraiser, you need to be well-versed in analyzing different pieces of art by using a wide variety of resources, such as books, photographs, and other artworks in order to determine the value of the piece. So, if you visit a museum or an art gallery, you can deduct expenses for the same.

Click here to find out how FlyFin can help you to take this as a deduction.

Frequently asked questions

FAQs

Can I deduct charitable donations made to the museum?

Can an independent musician claim a tax deduction for attending a concert?

What’s FlyFin?

FlyFin caters to the tax needs of freelancers, gig workers, independent contractors and sole proprietors.

But anyone can file taxes through FlyFin! FlyFin tracks all your business expenses automatically using A.I. technology.

Then, our CPA team files a guaranteed 100% accurate tax return for you – to save you a couple thousand dollars and a ton of time on your taxes.

In addition, you can download the FlyFin app and have your taxes filed in less than fifteen minutes, saving time and money.

Expert tax CPAs ensure 100%-accurate tax filing

A.I. finds every tax deduction, eliminating 95% of your work

On average users save $3,700

Was this tip useful?

Yes

No